Inflation Calculator

Inflation Calculator

An inflation calculator is a powerful tool designed to help individuals and businesses understand the impact of inflation on the purchasing power of money over time. It provides a practical way to adjust for the rising cost of living and assess the real value of money in different periods. Here's a comprehensive overview of how an inflation calculator works and its key components:

Table of Content

- Purpose and Function

- Input Parameters

- Calculation Methodology

- Calculate Yearly Inflation Rates

- Divide by the Number of Years

- Example

- Result Output

- Comparing Inflation Rates Over Time

- Limitations and Considerations

Purpose and Function

An inflation calculator serves the primary purpose of quantifying the effects of inflation on the value of money. It allows users to input historical or future dates, an initial amount of money, and calculates the equivalent value of that amount in terms of today's purchasing power, taking into account the changes in the consumer price index (CPI) or another inflation measure.

Input Parameters

Users typically input the following parameters into an inflation calculator:

- Starting Year and Ending Year: The time frame over which the inflation adjustment is to be made.

- Initial Price and Final Price: The amount of money or the value of a financial transaction in the chosen starting/ending year.

- Annual Inflation Rate: The expected or historical average annual inflation rate used to adjust the initial amount.

- Total Inflation Rate: The expected or historical average annual inflation rate used to adjust the initial amount.

Tips for Effective Use:

- Ensure the inflation calculator you choose is reliable and uses a consistent methodology.

- Use realistic inflation rates based on historical data or expert forecasts.

- Consider the limitations of the calculator, such as the assumption of a constant inflation rate.

Calculation Methodology

The calculator uses a formula based on compound interest principles to adjust the initial amount for inflation over the specified time period. The formula takes into account the cumulative effect of inflation, compounding annually, to determine the equivalent purchasing power.

Calculate Yearly Inflation Rates:

For each year within the chosen time period, calculate the year-over-year inflation rate using the following formula:

Here, CPI stands for the Consumer Price Index, a common measure of inflation. The formula calculates the percentage change in the CPI from one year to the next.

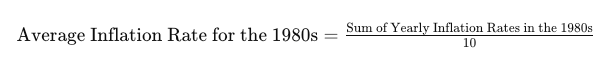

Divide by the Number of Years:

Divide the sum of the yearly inflation rates by the number of years in the chosen time period. This gives you the average inflation rate for that period.

Example:

Let's say you want to calculate the average inflation rate for the 1980s. You obtain yearly inflation rates as follows:

- - 1980: 13%

- - 1981: 10%

- - 1982: 6%

- - ... (continue for each year)

You sum up these rates and divide by the number of years (e.g., 10 years in the 1980s) to get the average inflation rate for the 1980s.

This methodology allows for a standardized comparison of average inflation rates between different time periods, providing insights into the overall inflationary trends over the specified intervals.

Result Output

The output from an inflation calculator typically provides the adjusted value of the initial amount in today's dollars or the currency of choice. This adjusted value reflects the impact of inflation and allows users to understand how the purchasing power has changed over time.

- Purchasing Power Erosion:

- Explanation: Inflation erodes the purchasing power of money over time. As prices rise, the same amount of money buys fewer goods and services.

- Impact on Investments: If investment returns do not outpace inflation, the real (inflation-adjusted) returns may be lower than expected.

- Nominal vs. Real Returns:

- Explanation: Nominal returns are the actual returns on an investment, while real returns are adjusted for inflation.

- Importance: Investors should focus on real returns to assess the actual increase in purchasing power.

- Asset Allocation Strategies:

- Inflation-Protected Assets: Consider including assets that historically perform well during inflationary periods, such as Treasury Inflation-Protected Securities (TIPS) or commodities.

- Diversification: Diversifying across asset classes can help mitigate the impact of inflation on a portfolio.

- Equity Investments:

- Historical Perspective: Historically, equities have provided a hedge against inflation over the long term.

- Consideration: While stocks may offer protection, not all stocks respond the same way to inflation. Certain sectors, like commodities, energy, and real estate, may perform differently.

- Real Assets and Commodities:

- Explanation: Investments in real assets like real estate and commodities often have intrinsic value and can act as a hedge against inflation.

- Consideration: Commodities, such as gold and silver, are often considered inflation hedges due to their tangible nature.

- Inflation-Linked Bonds:

- TIPS: Treasury Inflation-Protected Securities (TIPS) adjust with inflation, providing a guaranteed real return.

- Consideration: TIPS can be a valuable addition to a diversified portfolio for investors concerned about inflation.

- Interest Rates and Bonds:

- Inverse Relationship: Generally, as interest rates rise, bond prices fall.

- Risk: Fixed-rate bonds face the risk of losing value in an inflationary environment.

- Dynamic Investment Strategies:

- Active Management: Active portfolio management allows for adjustments in response to changing economic conditions, including inflation.

- Risk Management: Regularly assess and adjust the investment portfolio to manage risks associated with inflation.

- Dividend-Paying Stocks:

- Consideration: Stocks that pay dividends may provide a source of income and potential protection against inflation.

- Research: Analyze the historical dividend growth of companies to assess their ability to maintain payouts during inflationary periods.

- Global Diversification:

- Benefits: Investing globally can provide exposure to economies with varying inflation rates.

- Currency Consideration: Be mindful of currency risk and its impact on international investments.

- Investment Horizon and Planning:

- Long-Term Perspective: Inflation's impact is often more pronounced over the long term. Long-term investors may have the flexibility to ride out short-term fluctuations.

- Financial Planning: Incorporate inflation expectations into financial planning to ensure investment goals align with future purchasing power needs.

- Regular Monitoring and Adjustments:

- Continuous Evaluation: Regularly assess the investment portfolio in light of changing economic conditions.

- Rebalancing: Make adjustments to the asset allocation and investment strategy based on evolving inflation expectations.

Comparing Inflation Rates Over Time

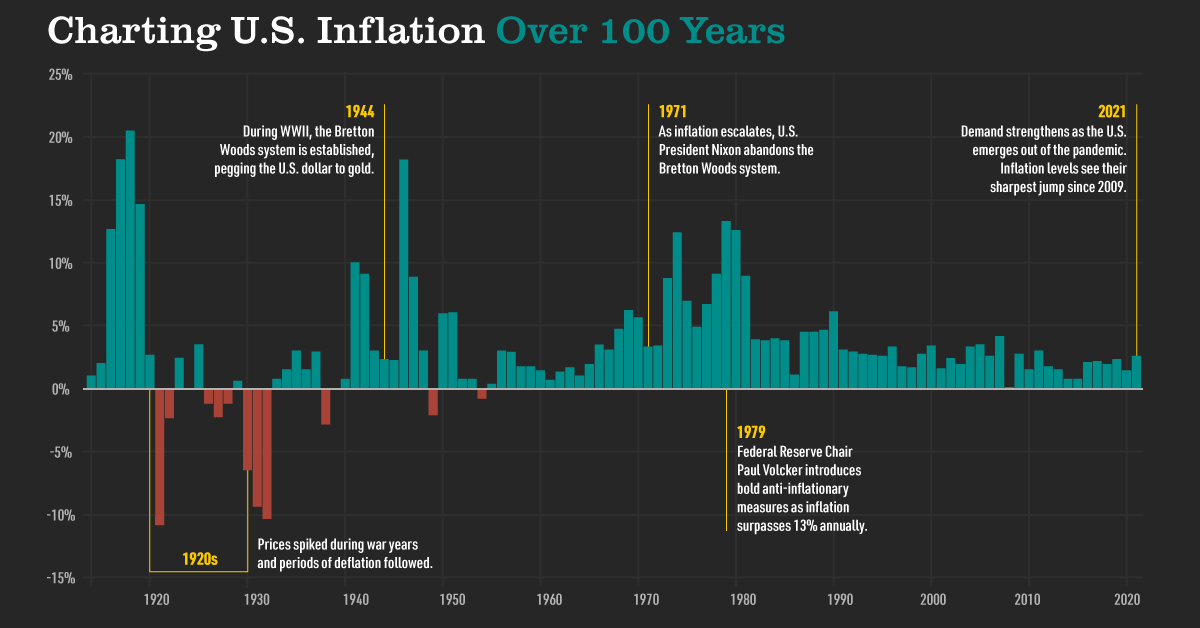

Comparing inflation rates over different time periods is a valuable exercise for gaining insights into economic trends, policy effectiveness, and the overall health of an economy.

Case Study Example:

For example, comparing inflation rates in the 1980s, known for high inflation, to more recent periods could involve analyzing the impact of central bank policies, technological advancements, and globalization on inflation trends.

Limitations and Considerations

While inflation calculators are valuable tools, it's essential to be aware of their limitations. These calculators assume a constant inflation rate over the specified period, which may not accurately reflect real-world economic conditions. Additionally, they may not account for changes in spending patterns or individual circumstances.

In conclusion, an inflation calculator is a valuable resource for anyone looking to understand the long-term impact of inflation on their finances. By using this tool, individuals and businesses can make more informed decisions about saving, investing, and planning for the future in the face of changing economic conditions.